The State of Indian Student Migration 2025 The Hidden Recession

If you have read the headlines this month, you have likely seen a staggering figure: 1.8 million Indian students are currently studying abroad. This represents a reported 40% jump from the previous year.

But if you are a university stakeholder, a student housing provider, or an investor, you might be wondering: “If numbers are up 40%, why are university applications to the UK and Canada flatlining?”

The reality? The “boom” is a statistical illusion. The “University Recession” is real.

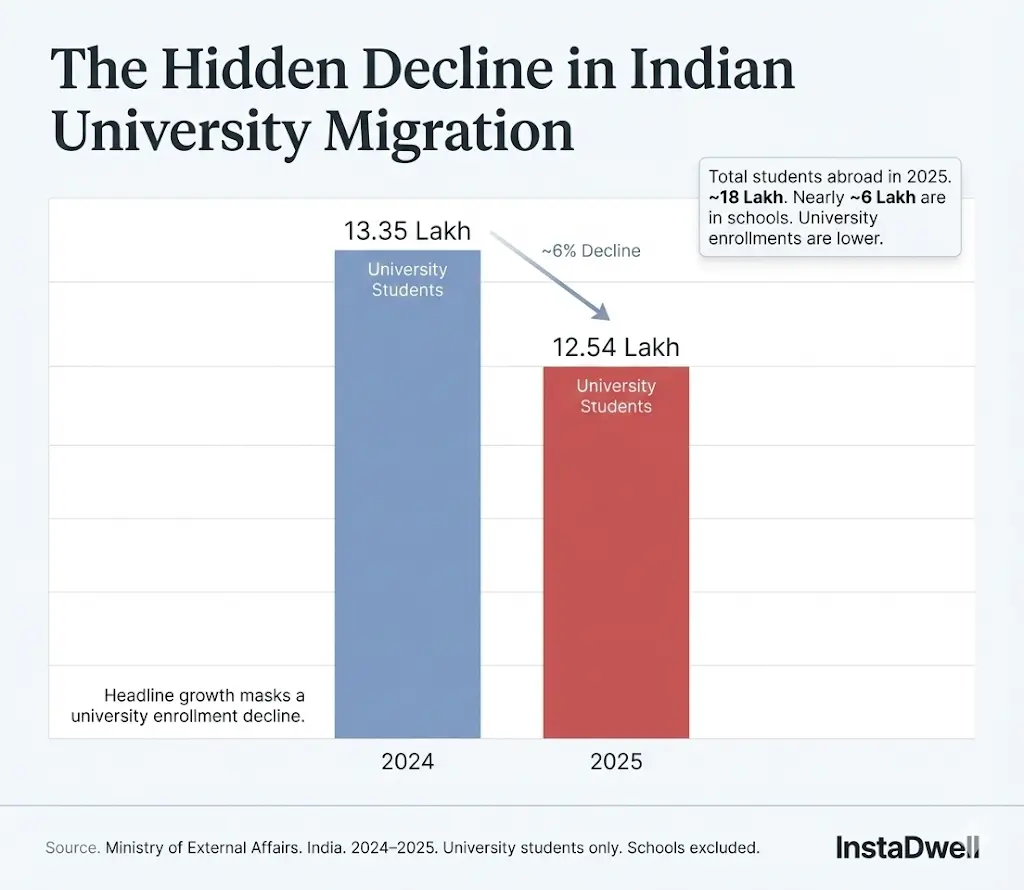

1. The “Hidden Decline” in Higher Education

The massive growth in the headline number comes from a change in government reporting. For the first time, the 2025 MEA data includes Indian students in K-12 schools abroad.

When we strip out the school data and compare “apples to apples” (University students only), the trend reverses entirely.

Source: Ministry of External Affairs, India (2024–2025)

(While total numbers are up, university-level enrollments have actually dropped by ~6%.)

-

2024 University Students: ~13.35 Lakh

-

2025 University Students: ~12.54 Lakh

-

The Real Trend: A ~6% decline in actual higher education enrollments.

The core “Study Abroad” market, students pursuing Master’s and Bachelor’s degrees, has actually shrunk. The decade-long growth streak has hit a ceiling driven by tighter visas and rising costs.

2. The “InstaDwell Sentiment Score”: Fear Over Rankings

Why the decline? We analyzed sentiment across major student forums in December 2025 to understand the emotional drivers of this shift. We found that “Job Anxiety” has replaced “University Ranking” as the #1 decision metric.

The Canada “Exodus”

Sentiment for Canada has turned overwhelmingly negative. In popular threads on r/studyAbroad (December 2025), students are actively warning peers that the country is a “gamble.” The lack of PR pathways for non-French speakers has led to a consensus: “Unless you have a job offer in hand, walk away.”

The UK Visa Panic

On r/UniUK, the conversation is no longer about coursework. It is dominated by policy fear. Threads like “Graduate Visa Timeline” highlight that students are prioritizing visa security over university prestige, with many fearing that post-study work rights could be curtailed further.

The Germany Pivot

Germany is winning the “Value War.” Students comparing UK vs. Germany are overwhelmingly leaning toward Germany for its low tuition. However, the barrier has shifted: forums warn that C1-level German is the new “tuition fee”; without it, the job market is closed.

3. The “Student Affordability Index”

For the first time, we modeled the “Economic Reality” of a student living in major hubs. We compared Q4 2025 market rents against the earning potential of a standard 20-hour/week part-time job.

The “Survival Ratio” (Rent as % of Part-Time Income)

| City | Avg. Student Rent (Shared) | Est. Part-Time Earnings (20 hrs/week) | % of Income Spent on Rent | Verdict |

|---|---|---|---|---|

| Berlin | €600 – €800 | ~€960 (Min Wage) | ~73% | Tight, but Manageable |

| London | £850 – £1,200 | ~£900 | ~110% | Unsustainable |

| Toronto | CAD 1,400+ | ~CAD 1,300 | ~108% | Unsustainable |

The Insight: In London and Toronto, a student cannot survive on part-time work alone; they require significant parental support. In Germany, the math still (barely) works. This economic hard-stop is the primary driver of the migration shift we are seeing in the MEA data.

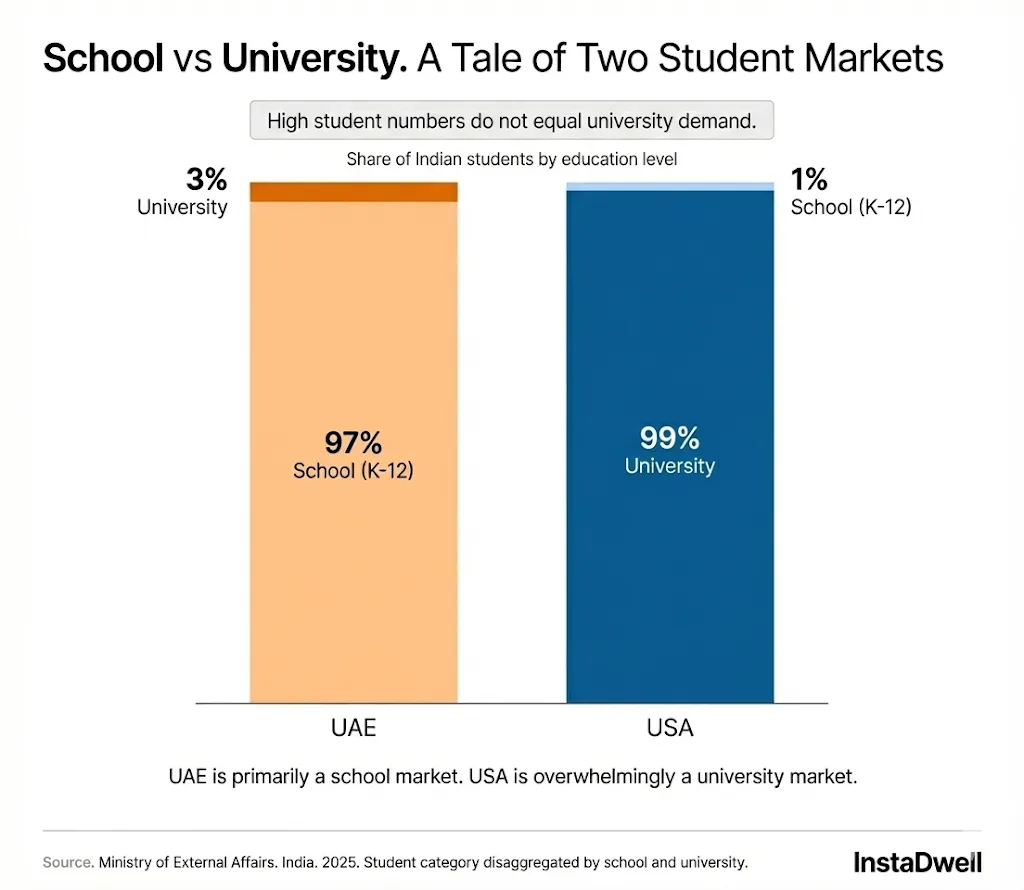

4. The “School vs. University” Split

The data also reveals a massive geographic split that distorts the global numbers. The “Student” population in the Gulf is fundamentally different from the West.

Source: Ministry of External Affairs, India (2025) · Visualization by InstaDwell

(The UAE is a family market. The USA is a university market. Don’t confuse the two.)

-

UAE: 97% of the “student” population are school children (K-12).

-

USA: 99% are university students.

For PropTech companies and education recruiters, conflating these two markets is a critical error. A “boom” in UAE numbers does not mean more demand for student housing; it means more demand for international schools.

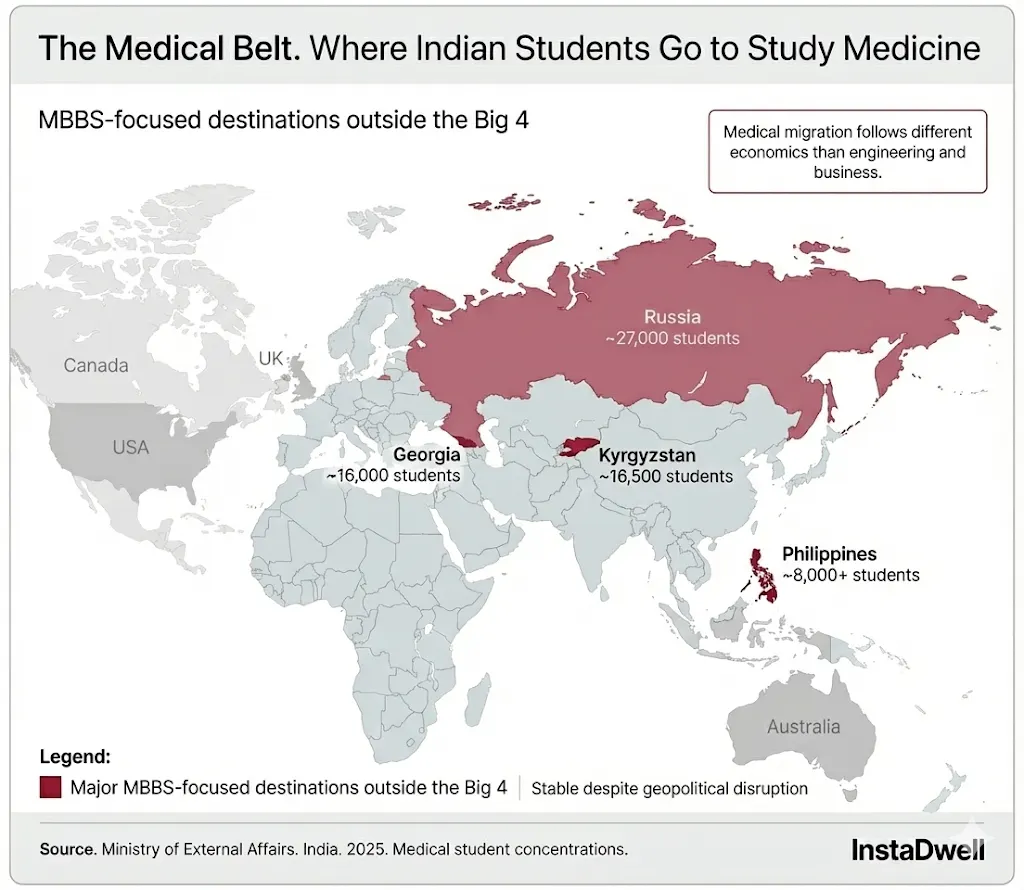

5. The Rise of the “Medical Belt”

With the “Big 4” destinations becoming expensive or restrictive, Indian medical students are redrawing the map.

Source: Ministry of External Affairs, India (2025) · Medical student concentrations · Visualization by InstaDwell

(Central Asia and Russia remain the primary hubs for budget medical education.)

We are seeing a clear shift toward “Budget Medical Destinations” in Central Asia and Russia, which remain resilient despite geopolitical tensions. Uzbekistan and Russia are absorbing the demand that previously flowed to Ukraine, creating a distinct “Medical Belt” that operates on completely different economic logic than the Engineering/Business student flow.

Conclusion: A Year of Correction

The 2025 student migration story isn’t about “record growth.” It is about correction and diversification.

As the Anglosphere tightens its borders and raises its rents, the flow of Indian talent is finding new paths. The next wave of growth will not come from traditional hubs, but from “Value Destinations” like Germany and the resilient “Medical Belt.”